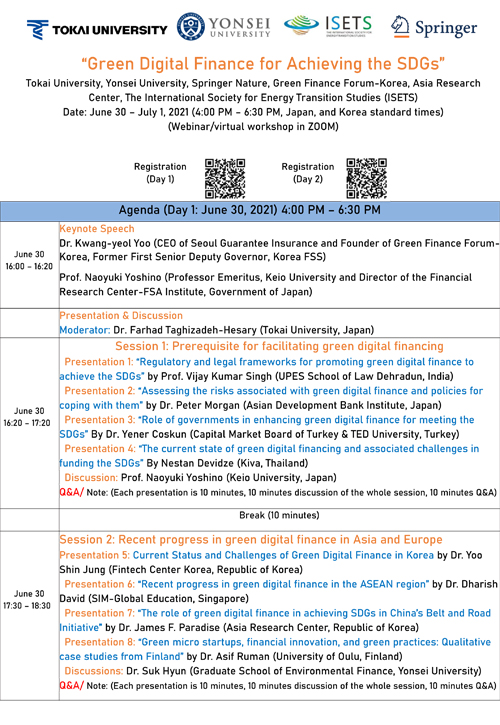

OnlineSymposium

Green Digital Finance for Achieving Sustainable Development Goals

Webinar date: June 30, 2021

Organizers: Tokai University and Yonsei University

The webinar is for the call for papers on Green Digital Finance for Achieving Sustainable Development Goals (Book)

(Book Editors: Dr. Farhad Taghizadeh-Hesary and Dr. Suk Hyun)

Registration of day 1 (June 30, 2021):

https://zoom.us/webinar/register/WN_h8IhUaF0QU6oR9Z8MmdEmw

Registration of day 2 (July 1, 2021):

https://zoom.us/webinar/register/WN_PfUB6VNnQz6Mzu2oiCbb4w

Outline and background:

To meet obligations under the Paris Agreement and achieve sustainable development goals (SDGs), significant investments in renewable energy (RE) production and infrastructure are necessary worldwide. An estimated USD 5-7 trillion of annual investment will be needed to deliver on UN SDGs and the Paris Agreement on Climate Change (Brookings, 2016). However, in 2017 and 2018, global investment in renewables and energy efficiency declined by 1 and 3%, respectively. There is a risk that it will slow further; clearly, fossil fuels still dominate energy investment (IEA, 2018). This could threaten the expansion of green energy needed to provide energy security and to tackle climate change. (Sachs et al. 2019). In 2019, RE investment increased by 1% to 311 billion US$. However, energy efficiency investments reduced from 252 billion US$ to 249 billion US$ (IEA, 2020). IEA estimated that in 2020 due to the COVID-19 pandemic and the global economic recessions, the ongoing investment in RE projects fell by around 10% for the year. Energy efficiency investment may fell by over 12% in 2020, mostly due to the 6% assumed decline in global economic growth, potentially in response to less available capital for efficiency projects and lower energy prices. Energy efficiency investment is not enough to meet sustainability goals and reduce the effort required from the energy supply. The COVID-19 pandemic and the economic downturns resulted in a drastic reduction in fossil fuel prices. Low fossil fuel price is harmful to developing renewable energy projects, making solar, wind, and other RE resources less competitive electricity sources. This could threaten the expansion of green energy needed to provide energy security and meet SDG7 and SDG13. (Yoshino, Taghizadeh-Hesary, and Otsuka, 2020).

Although most recently, several new green financing solutions such as green bonds, green banks, green credit guarantee, carbon taxation, carbon trade, village funds, community trust funds have been established in different countries, the aforementioned data shows that these are not sufficient, and alternative ways to finance projects are required. (Hyun, Park and Tian, 2020, Taghizadeh-Hesary and Yoshino, 2019; 2020)

Technological innovation is already offering sustainability solutions across the financial system’s five core functions: moving value, storing value, exchanging value, funding value creation; and managing value at risk. (UNDP, 2019). Increasing transparency, accountability, decentralization of the financial system, improving risk management, increasing competition, lowering the costs and improving efficiency, increasing the speed, increasing cross-sectoral collaboration and integration are the features that the financial technology (FinTech) can provide (UNDP, 2016). Artificial intelligence (AI), distributed ledger technologies (DLT) or blockchain, peer-to-peer lending platforms, big data, internet-based and mobile-based payments, Internet of Things (IoT), matchmaking platforms including crowdlending, tokenizing green assets are potential means to scale up the green finance for achieving the SDGs (Yoshino, Schlosser and Taghizadeh-Hesary, 2020). According to UNEP (2018), AI could lift global GDP by US$15-20 trillion by 2030. Securing the resilience of such an achievement, notably its environmental and social sustainability, may well be accomplished by digitalizing finance or ‘digital finance.’

Against this background, Tokai University and Yonsei University are organizing call-for-papers to receive high-quality empirical, theoretical, or case study papers to be published in a book volume titled “Green Digital Finance for Achieving Sustainable Development Goals” by Springer Nature and indexed in Scopus.

・Deadline for submission of the extended abstracts (1000 words:) May 31, 2021.

・Announcement of the acceptance: June 10, 2021

・Date of webinar: June 30, 2021

・Deadline for submission of the full papers: July 31, 2021.